This article originally appeared in the 2018 September/October issue of PARCEL.

Many small and mid-sized shippers feel that they don’t have the time or resources to effectively negotiate carrier contracts or manage their transportation spend. In many cases, they feel intimidated by the carriers and don’t think they have many options or flexibility.

What can shippers do? In one word: prepare. One of the best preparation techniques is to utilize resources commonly employed by the largest shippers in the country: robust data analytics, opportunity assessments, modal optimization, strategic sourcing, and RFPs with customized requirements.

Understanding Your Data

The first step is to create your own shipping database using shipment level detail. While most of this data is available from the carriers, it is a mistake to only rely on their reporting and projections.

Most, if not all, shippers are now on weekly electronic invoicing, and you can use these weekly files to create your database. Unfortunately, with up to 250 fields in their invoicing, the carriers don’t make it easy to mine data to create meaningful reports. Another option is to pull down shipment level detail from online carrier reporting utilizing FedEx Reporting Online or UPS Billing Center.

To get the right shipment level detail, all you need are several key fields. Keep the ship date, the service level, the billed and actual weight, the zone, and the current shipment cost and incentives. On a separate tab, break out the accessorial/miscellaneous charges along with any charge descriptions. This will help capture your accessorial spend like residential surcharge, delivery area surcharge, additional handling, fuel, etc.

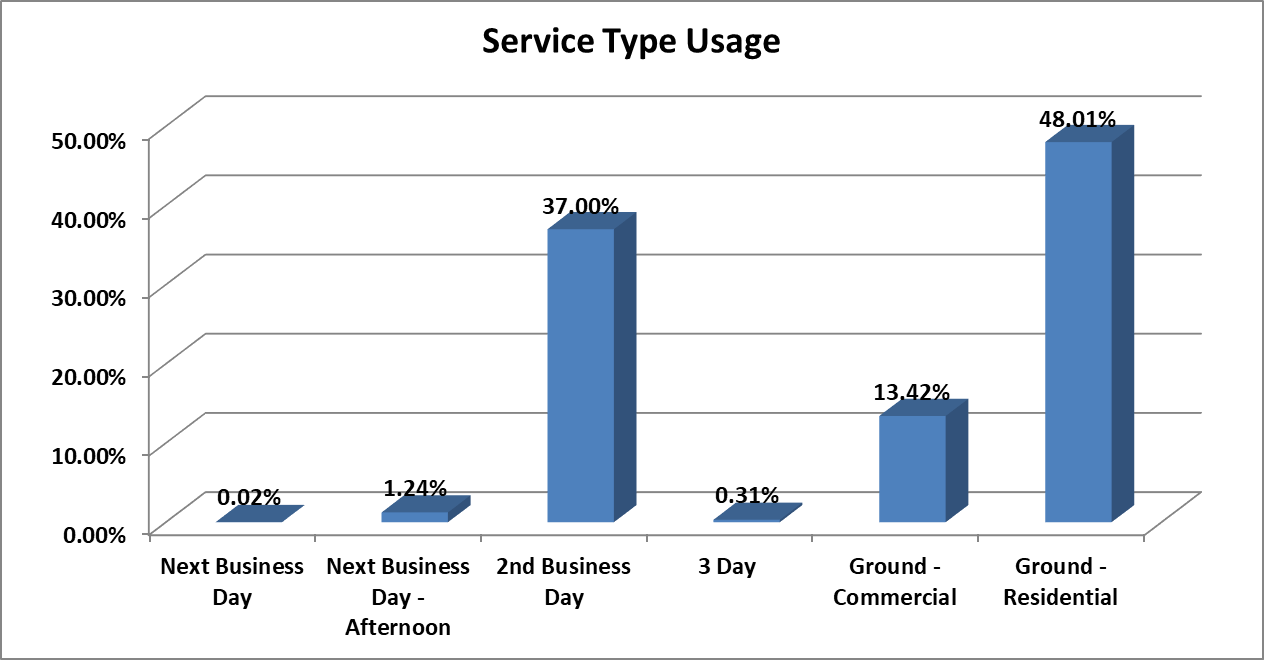

The first and most important analysis we recommend running is a breakout of shipments and revenue by service level. This helps you identify specifically where your shipping dollars are going. As part of this report, we also look at the difference between realized discounts on the invoice and contract discounts. While most shippers feel that they have negotiated good discounts in their carrier agreement, they are surprised when these contract discounts don’t match their invoices.

The result of this analysis usually shows that the main reason that shippers do not receive their full ground contract discount is the Zone 2, one pound minimum contract exclusion. This exclusion means that you receive fewer incentives if the net charge is below the zone 2 minimum ($7.57).

Minimum reductions can also impact your express costs. If you see discrepancies between your contract incentives and your invoice incentives, look at the minimum reductions for each express service.

Over the years, our analysis shows that minimum shipment charges can impact 50-90% of all ground shipments. For many shippers, it is more important to negotiate reductions in the minimum shipment charge than it is to negotiate higher discounts.

Don’t Overlook the Weight and Zone

Another important analysis is to look at the weight of your shipments. Lower weight shipments tend to hit the minimum shipment charge. Additionally, break out all shipments by weight categories that match your contract discount groupings. Many times, you will find that your higher discounts may be in weight categories that don’t match your actual distribution. As an example, if your contract incentives break out by one to five pounds and then six to 10 pounds, ask your carriers to extend the discounts to one to 10 pounds if that will increase your discounts in the lower weights.

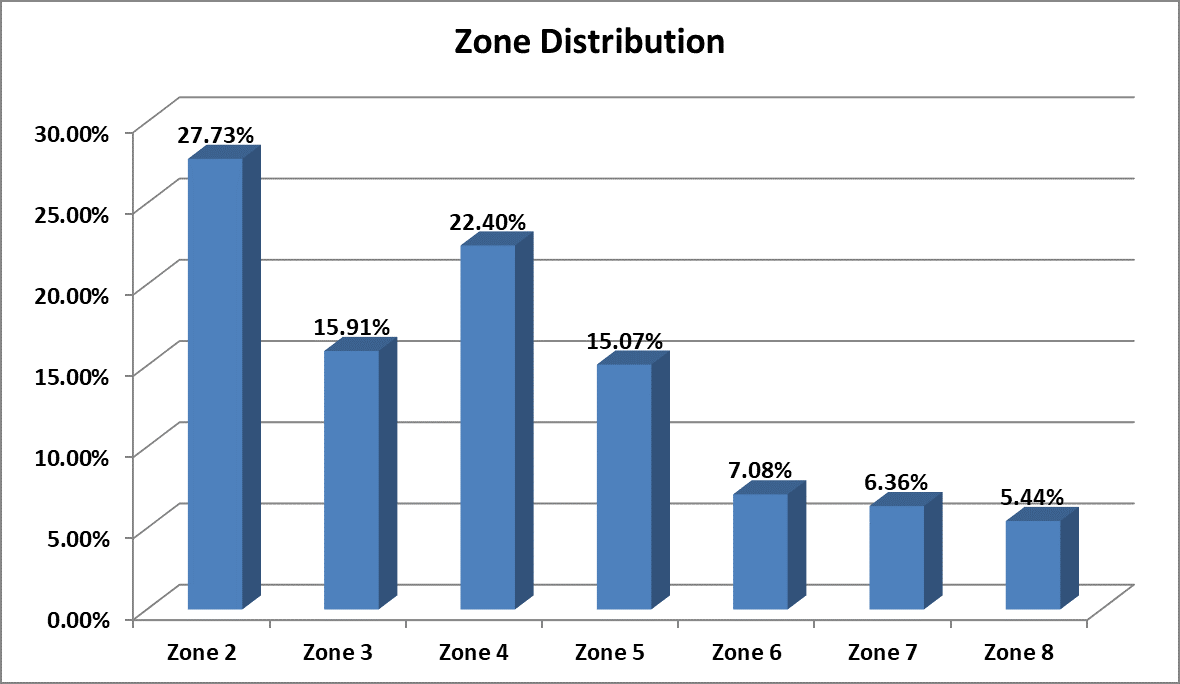

Next look for the percentage of your ground residential shipments that are between one and nine pounds. If this is a significant portion of your shipments, there may be an opportunity to modally optimize and shift these lower weight shipments to a less expensive service like UPS SurePost or FedEx SmartPost.

Sorting your shipments by zone can also be useful and further assist with modal optimization. If you have significant Zone 2-5 shipments, look carefully at your service usage. For example, if you are utilizing an express service to Zone 2, you can get next-day delivery with a less expensive ground service that is guaranteed. Also, many shippers discover that they use three-day express services when they can get better or similar ground transit times to the shorter zones.

Zone information also helps with any decision to convert some of your lower weight ground shipments to a hybrid service. Typically, the shorter the zone, the less transit time difference there is between a ground shipment and a SurePost/SmartPost hybrid service. This will make the implementation more successful.

Zone information can also help identify whether a regional carrier might be a good fit for your company. Many regional carriers have expanded their service areas and can now handle a larger proportion of your overall shipping. Regional carriers can offer many important advantages like lower rates, less accessorial charges, and even better transit times.

Understanding Shipment Level Detail and Accessorials

Shipment level detail can help shippers determine the impact of the carriers’ new dimensional rules. Focus on two columns: “Actual/Original Weight” and “Billed/Rated Weight.” If the invoiced weight of the shipment is higher than the actual weight, you are getting hit with additional dimensional charges. The next step is to request that your carriers provide you with an electronic billing format that gives you the length, width, and height for each package. When multiplied together, you will see the total cubic inches of each package. Apply the carrier dimensional factor, and you will see the true invoiced weight and cost of each oversize shipments. Compare this to your packaging and you can then identify which boxes incur the highest dimensional weight.

With this data, you can establish your incremental costs and may be able to negotiate a non-standard dimensional factor that benefits your company’s unique packaging and shipment mix. We have seen many shippers lower their costs by hundreds of thousands of dollars utilizing this approach.

The last, but not least, important step is to conduct analysis on your accessorial spend. These add-on charges can account for up to 30% of your overall transportation spend. Common charges are: Residential Add-on, Delivery Area Surcharges, Fuel Surcharge, Oversize, and Additional Handling.

Accessorial costs can be accessed either through your invoicing or from the carriers’ online reporting. Identify which charges impact you the most by both shipment volume and cost. Then, work with your carrier to customize discounts in your highest spend category.

Looking at accessorial concessions is also very important when you are looking at the impact of the carriers’ annual general rate increase. Typically, accessorial charges are not covered by a rate cap, and they can be significantly higher than the announced tariff increases. This is also a good time to ask your carriers to increase their discounts to offset the higher tariff costs.

There are many values to conducting all these analyses. Not only will you identify savings opportunities, but you will also establish a lot of credibility with your carriers. Your RFP requests will be on target and you will have created a database that will allow you to efficiently evaluate the financial impact of any new carrier proposals.

Tim Sailor is the founder of Navigo Consulting Group, which specializes in contract optimization, distribution analytics, and strategic sourcing. As an 11-year speaker at PARCEL Forum, Tim will be presenting “Effective Transportation Spend Management.” You can reach Tim at 562.621.0830 or Tim@NavigoInc.com.

Click here to return to the auditing topic page.