Buckle up, folks. 2023 is shaping up to be an especially eventful year in the parcel industry. Economic conditions continue to drive industry change, and both FedEx and UPS are facing unique challenges in the upcoming year. How these events play out will have wide-ranging implications for shippers, carriers, and consumers alike. Here are the industry events shippers should watch for and the steps to take to best prepare for a potentially volatile year.

FedEx Performance Concerns

FedEx Corporation faces a number of significant changes entering 2023. Most notable is the integration of its Express and Ground networks. Siloed by design in the original FedEx business model, FedEx announced the integration of these two distinct organizations, called Network 2.0, in June 2022. On the surface, this move represents a strategic decision to overcome operational inefficiencies and improve profitability over the next five years. The basic idea follows the notion that FedEx can leverage all of its capacity and optimize lower cost solutions (e.g., Ground) to execute on its commitments.

Long-term, the course charted by new FedEx CEO, Raj Subramaniam, seems to make sense. Many in the supply chain make similar decisions on a daily basis. However, as with many transformations of this scale, shippers should be wary and expect some operational pain in the short-term, especially in 2023.

FedEx service providers, the independent contractors who man the FedEx Ground network, represent a particular vulnerability to FedEx operations. As FedEx engages these providers on a per-stop, or per-mile basis, rises in cost – labor, fuel, equipment, etc. – could result in a number of providers folding shop. At this point in 2022, there is no indication that reliance on these operators will change in the new network schema, leaving this as a risk for 2023 performance.

On-time delivery is also a concern. Over the past two years, FedEx has particularly struggled with on-time delivery performance, hitting 84.8% in mid-December 2021, falling 10% YoY from 2020. UPS, by comparison, achieved 95.8% during the same period, and consistently outperformed FedEx throughout the year. As FedEx works towards network integration, it is unclear how the network changes will impact its on-time performance, but it is unlikely that it will dramatically improve.

The 2022 peak season will provide a bell-weather as to what shippers can expect in 2023. Tactically, shippers should monitor performance metrics on a weekly basis, especially in the early months of 2023 to protect against potential service disruptions to customers. Understanding the importance of on-time delivery, and what service or carrier options are available, will be necessary for a successful year.

UPS Labor Negotiations

United Parcel Service (UPS) enters 2023 in a similarly precarious position as the 2018 Teamsters Union Agreement is set to expire on July 31, 2023. Early indications show that this could be a particularly contentious renegotiation as the Union presses on eliminating driver tiers and increasing wages. As the largest parcel carrier in the United States, the consequences of this negotiation, for better or worse, will have wide-ranging implications. Industry observers should expect to see the word, “strike,” frequently in the coming months. Do not take it lightly.

The Teamsters Union last held a general UPS strike in 1997. The strike lasted 16 days and cost UPS hundreds of millions of dollars. For shippers locked in UPS agreements, the cost was significantly higher and ravaged shipper-carrier relationships.

In sum, when making plans for 2023, UPS shippers ought to consider what their contingency plans are in the event of a UPS service disruption. Begin compiling a plan that lays out the resources necessary to pivot to an alternative carrier should the need arise. In other words, if a secondary carrier is needed, do you already have the contracts in place? Do you have the shipping bays to facilitate a new carrier? Is my operation flexible enough to handle a new sort process? Is IT aligned or will changes need to be made? All these questions and more should form the basis of contingency planning. It is unlikely that UPS will allow negotiations to reach the threshold of a strike, but not out of the realm of possibility. Be ready.

Expected Inflationary Pressures

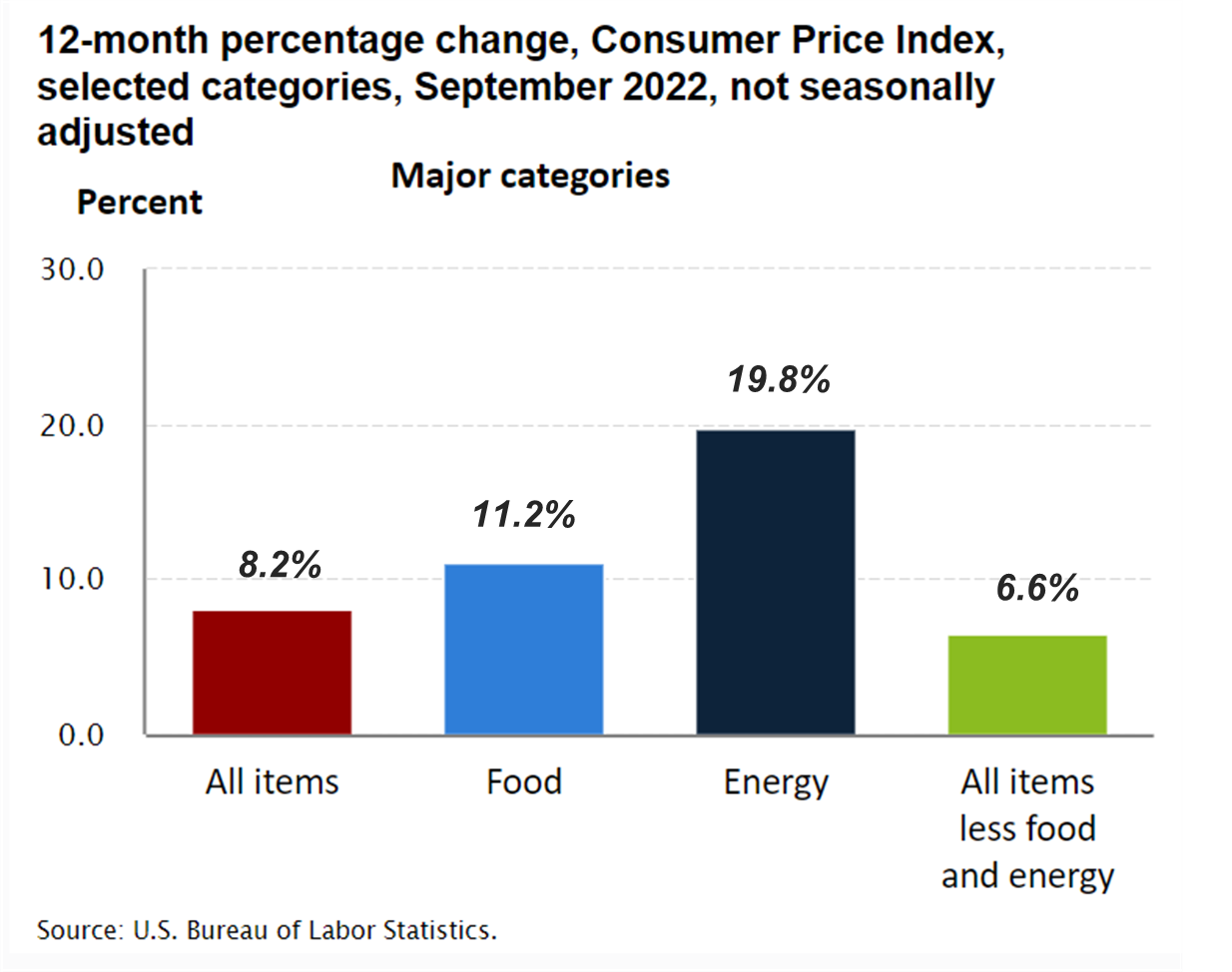

Economic conditions remain uncertain for 2023, however, early indications paint a lackluster picture. The Consumer Price Index (CPI), a measure of price change over time (i.e., inflation) currently shows a 6.6% YoY increase (less Food and Energy) with little sign of abatement. Energy, including fuel costs, is significantly higher YoY, at 19.8%. Both metrics play an important role in the transportation industry as carriers scramble to contain cost.

|

While many in the industry are painfully aware of fuel surcharge metrics – and the frequency at which these tables can change – one of the newer tactics taken by carriers involves the CPI. FedEx, and to a lesser extent DHL, have both begun including language surrounding general rate increase (GRI) caps, making them contingent upon three-month average CPI increases. Specifically, if the CPI exceeds a certain average percentage over a three-month period, contractual caps are waived. This means that shippers will receive the full published increase year-over-year. Be on the lookout for this type of language if you plan on negotiating contracts in 2023 or beyond.

As 2023 unfolds, inflation – along with the other hurdles carriers will be grappling with – will determine much of what we can expect going into the 2023 peak season and 2024. The GRI is now officially 6.9% for both FedEx and UPS and 7.9% for DHL. These percentages may become a more normalized (even low) expectation for the next few years. Carriers have been creative with these increases in the past, so it is also possible that exceptions for areas such as fuel may make a reappearance in their calculations. For peak season, shippers should also brace for some “creativity.” UPS will be licking its wounds after a labor negotiation, and given its focus on revenue quality, the 2023 peak season may be an early opportunity to relieve the pain. For its part, FedEx has been struggling with its revenue, period. If Network 2.0 underperforms, the 2023 peak season also represents a potentially lucrative opportunity. In short, cost increases will be a recurring theme in 2023. Remaining updated on the industry and in frequent communication with your parcel service provider will be must for all shippers.

What Can I Do to Prepare?

1. Review Existing Carrier Agreements: Devoting time to look over existing carrier agreements is an essential step in developing a sound 2023 strategy.

Look to answer the following questions: When does my agreement expire? Are my revenue-based discounts secure with an expected increase or decline in shipping volume? Do I have agreements with multiple carriers? If yes, am I optimizing them?

These questions, and more, will help narrow down any necessary actions or analysis that needs to take place and create a rough timeline for execution. It is also important to note that while contract negotiation is usually the best option for savings, if your program is looking at a change in volume, amending your existing agreement or securing an extension can be a sound short-term decision.

2. Secure a Secondary Carrier (if You Can): Securing a backup agreement with a secondary carrier is a prudent step to mitigate the risk of a service disruption. Having the ability to continue shipping, even at an increase in cost, often outweighs the cost of sitting on idle shipments.

Right now, it is an especially good time to approach an alternative carrier as capacity begins to open back up following the COVID-19 peaks. Bear in mind minimum volume commitments and what it will take to maintain the relationship in the interim.

3. Manage Carrier Allocation: Over the last two-year period, one of the more common industry trends involves carrier diversification. Josh Dinneen, Chief Commercial Officer at LaserShip/OnTrac recently authored a great article in Parcel Magazine discussing these advantages.

What I would add here, is that if you utilize multiple carriers and expect a change in volume, be mindful of how your shipments are allocated. Most FedEx and UPS contracts today include revenue-based discounts sensitive to changes in volume. Moving too much volume to a second carrier can result in an overall cost increase if you are unaware of these thresholds. Look at recent carrier invoices to determine current tier calculations or contact a freight audit provider if you are concerned about volume changes.

4. Implement Rate-Shopping Software: Rate shopping software is an excellent tool to manage costs, manage carriers, and maintain customer commitments. As cost-reduction efforts continue to increase in importance entering 2023, consider reaching out to a service provider today to understand if this software would be a good fit.

There is much to be on the lookout for in 2023. All signs point to an eventful year. Remaining proactive with your program, maintaining an open line of communication with your carrier, and planning through each scenario will be the best course of action to navigate a turbulent year.

Jack McCrum is Project Manager at Körber Supply Chain.

This article originally appeared in the November/December, 2022 issue of PARCEL.