Understanding the dynamic nature of parcel costs can be a daunting task that can take years to truly comprehend. Fuel surcharges, however, seem to be conceptually understood by all. This can be deceptive. While fuel may seem like it should be straightforward, there are three dynamic variables that impact fuel costs. With fuel prices skyrocketing, it’s important for shippers to understand these variables, how those have changed over time, and how they will impact their fuel surcharge.

Fuel Prices

The first area that impacts the carrier’s fuel surcharge is often the most impactful: fuel prices. US carriers will typically use average fuel prices that are published by the Energy Information Agency. The EIA publishes both weekly and monthly averages of the fuel prices. Although some carriers still utilize monthly averages, most domestic carriers have transitioned in recent years to leveraging weekly averages to realize changes in fuel prices more quickly.

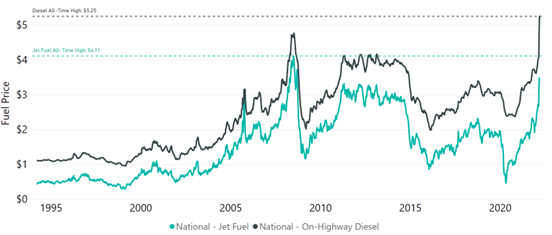

Figure 1 displays what the historical fuel prices look like for the indices utilized by FedEx and UPS. These indices are used to determine the Ground (National – On-Highway Diesel) and Express (National – Jet Fuel) fuel surcharges through March 14, 2022.

Figure 1

Evidenced here, fuel prices have increased to record highs for diesel, and close to record highs for jet fuel. Even without further changes to the fuel surcharge calculation, this would lead to an increase in fuel surcharge costs for shippers. Unfortunately, there have been other changes that compound this price spike.

Carrier Fuel Tables

The second variable that impacts fuel surcharges is the carrier fuel table. These fuel tables have bands of fuel prices that convert the fuel prices into a rate. For UPS and FedEx, this rate is a percentage that is applied to transportation rates as well as other select surcharges. Figure 2 shows a snapshot of the FedEx Ground fuel table that was in place from November 1, 2021, to April 3, 2022:

| At Least | But Less Than | Surcharge |

| $4.90 | $4.99 | 15.50% |

| $4.99 | $5.08 | 15.75% |

| $5.08 | $5.17 | 16.00% |

| $5.17 | $5.26 | 16.25% |

Figure 2

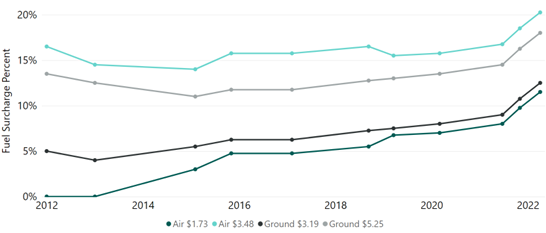

These fuel tables are designed so that when fuel prices go up, so does the surcharge. Conventional wisdom might suggest that these tables would stay relatively static, but that is not the case. Using the fuel prices as of March 14, 2022 ($5.25 for diesel, $3.48 for jet fuel) as well as the fuel prices for the same time during 2021 ($3.19 for diesel, $1.73 for jet fuel), Figure 3 shows what the surcharge would have been since 2012 using the FedEx fuel tables in place at that time.

Figure 3

We can also take the fuel prices from Figure 1 and the fuel tables that were in place at the time to map out the actual historical fuel surcharges, as seen in Figure 4.

Figure 4

There are a few interesting things worth noting from each graph:

1. Changes to the fuel tables could have different implications depending on what the fuel price is. For example, the change in the fuel table from 2013 to 2015 decreased the fuel surcharge for the higher prices, but it increased the fuel surcharge at the lower prices.

2. The last two changes to the FedEx fuel surcharge tables represent much steeper increases than we’ve seen over the past 10 years.

3. With increasing fuel prices to go along with the fuel tables increasing, we are seeing fuel surcharges that are higher than any point in the last ten years.

Fuel Basis

The last variable in the fuel calculation is the array of transportation and accessorial charges that the fuel surcharge will apply to, also known as the fuel basis. The most common reasons why the fuel basis would change are when carriers implement their general rate increases (GRIs) or if a shipper signs a new agreement or amendment. In recent years, we’ve seen both new agreements and the GRIs come in with higher cost increases than years past. These changes would have a direct proportional impact to the fuel basis. Figure 5 shows how some of the surcharge changes from the 2022 rate increase would impact the fuel calculation.

| Surcharge | 2021 List | 2022 List | 2021 Fuel at 16% | 2022 Fuel at 16% | Accessorial % Change | Fuel % Change |

| Ground Economy DAS | $2.35 | $3.60 | $0.38 | $0.58 | 53% | 53% |

| Home Delivery DAS | $4.30 | $4.80 | $0.69 | $0.77 | 12% | 12% |

| Express Residential DAS | $4.70 | $5.20 | $0.75 | $0.83 | 11% | 11% |

| Home Delivery Resi Surcharge | $4.35 | $4.75 | $0.70 | $0.76 | 9% | 9% |

| Express Resi Surcharge | $4.95 | $5.30 | $0.79 | $0.85 | 7% | 8% |

Figure 5

The Whole Fuel Picture

Unfortunately for shippers, each piece of the fuel picture looks bleak right now. Fuel prices are going up, carriers are increasing their fuel tables, and the fuel basis is increasing faster than it has in recent years. However, that doesn’t mean shippers are powerless. There are many ways that shippers can keep fuel costs under control. The most straightforward way is through contract negotiations. Shippers can negotiate discounts on fuel, discounts on the fuel basis, or some larger shippers can even negotiate custom fuel tables. Another common way for shippers to keep fuel costs down is through carrier diversification. Although UPS and FedEx tend to have similar fuel surcharges, that is not the case for all carriers.

| Fuel Type | Start Date | End Date | Fuel Surcharge |

| FedEx Ground | 3/21/2022 | 3/27/2022 | 16.25% |

| FedEx Express | 3/21/2022 | 3/27/2022 | 18.50% |

| UPS Ground | 3/21/2022 | 3/27/2022 | 15.25% |

| UPS Express | 3/21/2022 | 3/27/2022 | 18.50% |

| USPS | NA | NA | None |

| DHL Ecommerce Domestic | 3/1/2022 | 3/31/2022 | $0.06 per lb |

| OnTrac | 3/21/2022 | 3/27/2022 | 15.50% |

| Lasership | 3/1/2022 | 3/31/2022 | 12.00% |

| Mail Innovations | 3/7/2022 | 4/3/2022 | 4.00% |

| LSO | 3/21/2022 | 3/27/2022 | 14.75% |

Table 3

When looking at the recent published fuel surcharges in Table 3, you can see that there is quite a bit of variability. USPS doesn’t charge fuel, DHL Ecommerce applies fuel on a per-pound basis, and Mail Innovations only has a four percent fuel surcharge for March. By utilizing carriers that apply fuel differently than UPS and FedEx, shippers can mitigate some of the cost increases that are being driven by fuel. Regardless of how shippers decide to tackle the rising fuel costs, understanding the impact and developing a mitigation plan should be a top priority for all shippers.

Keegan Leisz is a Project Manager at enVista, a global consulting and software solutions firm. In his role, Keegan is responsible for negotiating parcel carrier contracts and specializes in analytics. You can contact him at kleisz@envistacorp.com.

This article originally appeared in the May/June, 2022 issue of PARCEL.