Can the rapidly evolving logistics landscape that is precipitating change in rules and rates for small parcel carriers actually be an opportunity for shippers and carriers to work more closely?

During the last quarter of 2016, the logistics industry saw an untold number of articles and blogs regarding the 2017 rate increases announced by UPS, FedEx, and DHL. The common thread in most was that the 4.9% increase was not really a 4.9% increase but could be significantly greater depending on shipment weight and size, service type, and applicable accessorial charges, surcharges, and rule changes. The complexity of small parcel pricing makes it extremely challenging to accurately understand the impact on next year’s shipping cost. Numerous logistics consulting companies offered to decipher the details of the pricing and rule changes and evaluate the specific impact to shippers, which is dependent on shipping profile characteristics.

The small parcel market is transforming rapidly based on the demands of e-commerce, omni-channel capability and the bold moves of Amazon. Consumer demands are evolving, driven by Power Shoppers and Millennials. They are becoming more focused on not only cost but choice, control, and convenience of online shopping. This poses a challenge for shippers in their efforts to serve their customers. For example, Millennials are three times more likely to use an internet delivery service than non-Millennials, according to the 2016 UPS Pulse of the Online Shopper study. Carriers continue to evolve their services to provide more choices and flexibility, but pricing is complex and continues to increase squeezing margins of online sellers.

There is no shortage of insight and advice on how to sharpen one’s skills in negotiating small parcel carrier agreements. And while negotiating favorable discounts can drop more margin to a shipper’s bottom line, it must be remembered that the carrier is an extension of the online sellers’ value chain that touches the customer. And carriers must recognize that their services and pricing must allow e-commerce retailers to compete with Amazon. With this in mind, can shippers and carriers really work more collaboratively to profitably improve the customer experience?

Dan Gagnon, VP Marketing for Global Logistics and Distribution at UPS, offers three tips to improve collaboration.

1. Allow the carrier to understand your business strategy. Is the goal to double profit or double business?

2. Share as much information as you can about your products and customers. Understanding the characteristics of products as well customer buying behavior will enable the carrier to provide services that are appropriately suited to the shippers’ requirements and their customers’ needs.

3. See the big picture…. now and how it is evolving. Understanding total cost, not just the shipping cost, is important to overall success.

Clearly, these tips require a degree of collaboration between the carrier and the shipper that may not always be easy to find, but doing so will return benefits. Furthermore, both shipper and carrier must possess a common perspective that collaborative relationships are truly a win-win. Mr. Gagnon says that in his experience, working in partnership with shippers offers both initial benefits and benefits that continue to accrue as the business relationship evolves.

Shippers, however, harbor the concern that intertwining their operations too tightly with their carrier leaves them susceptible to price increases for which there is no alternative, since the cost of change to another carrier is unacceptably high. In fact, creating high switching cost is a widely used tactic in both the shipping as well as other industries.

Another concern for shippers is the possibility of significant disruption due to a labor action of a union-organized carrier. A recent example is the potential risk associated with the UPS aircraft maintenance workers’ recent authorization of a strike if their three-year-old negotiation fails to produce an acceptable contract.

So, can collaboration really exist in the small parcel shipping world? Collaboration is a relationship that is built on breaking down friction points and impediments between the shipper and carrier. It requires management buy-in, mutual trust, efficient flow of information, and the ability to understand and measure the benefits of the collaboration, ensuring a true win-win outcome.

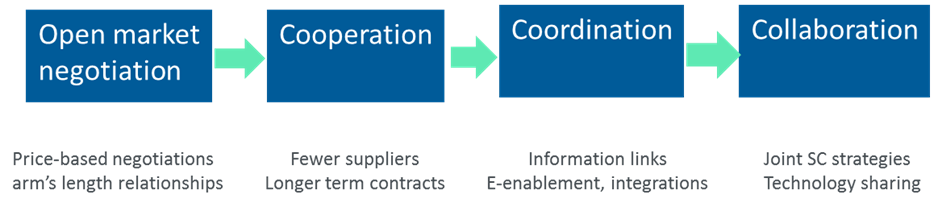

The diagram below suggests an approach in describing the increasingly aligned relationship between logistics providers and their customers. Most e-commerce shippers would fall in the cooperation or coordination category.

Source: Harrison, A. and Van Hoek, R. (2008), “Logistics Management and Strategy-Competing through the supply chain”, 3rd edition, Pearson Education Limited.

Company objectives, quarterly targets, product yields, and individual incentives can all work against collaboration if not properly aligned. That alignment may require a change of perspective for both carrier and shipper. Carriers need to consider the lifetime value of customers rather than looking at only product yields. Shippers must consider total costs, not just freight rates or discount levels. So what can prompt collaboration? The short answer is competition.

The duopoly of small parcel shippers has resulted in near parity between FedEx and UPS when it comes to services and pricing. A move on the part of one precipitates a near identical move from the other. But the landscape is changing. Competitive pressure from Amazon has disrupted the market in terms of cost and service.

Driven by the need to compete with offers such as free shipping, online retailers have been the catalyst for UPS, FedEx, and other carriers offering lower cost services using USPS last mile delivery. The evolving e-commerce landscape is the catalyst for improvements in service offerings beyond simple pickup and delivery of shipments

For example, both UPS, with MyChoice, and FedEx, with Delivery Manager, will notify recipients of impending deliveries, delivery delays, release signature, vacation holds, and enable recipients to redirect deliveries to alternative points or tailor a delivery window but for an additional fee. This capability serves the customer with more flexible delivery options while improving the delivery efficiency of the carriers through reducing re-deliveries. Although some e-commerce shippers encourage their customers to sign up for these services, the question is whether the uptake is significant. A collaborative approach would see the carriers develop an incentive scheme so that shippers could in turn incentivize their customers to register for this service or perhaps auto register them with the ability to opt-out.

Another area that is an opportunity for collaboration and an area in which Amazon has taken the lead is the return process. Providing free returns and quick refunds are high on the list of priorities for online shoppers. In fact, the UPS Pulse Online Survey indicates that 81% of online shoppers say it is important or very important for e-commerce sellers to offer free returns. Both UPS and FedEx offer return services which, if effectively implemented with outbound shipping, provide a convenient service and a high level of certainty that return shipments travel with the originating carrier. When combined with a customer-friendly refund process, online retailers can provide a return process that can compete with Amazon.

All key players in the small parcel market have “solutions” groups that offer value added services. The challenge for shippers is to understand whether these services actually meet the detailed needs of their business and at what cost. FedEx, UPS, and DHL proudly display case studies about customers who have been delighted with a solution to a critical business need. In some cases, the solutions leverage their core offerings, while others were delivered through their value-added capabilities.

Since your carrier is already part of your fulfillment or logistics supply chain, consider whether they can work more collaboratively. So, how can you do this? Here are several tips:

· Assess your current situation. Understand each step of your fulfillment value chain. Do you have metrics that tell you how you are doing? Do you know what your total cost of fulfillment is? Are there some aspects that are overly expensive? What are your customers saying about your fulfillment times? What about returns? What is the total cost of returns? Where are the areas for improvement? What are your objectives?

· Share your assessment with your carrier representative. Make sure your carrier knows your objectives, issues, and plans. Of course, share only what is appropriate, but this may be more that what has been shared historically.

· Ask your carrier representative to suggest how your company’s requirements can be addressed. If the carrier offers relevant services, request a proposal including complete pricing, implementation plan, metrics, and references.

· Since more of your logistics value chain will be placed in the carrier’s hands, make sure there is a contingency plan in the event business does NOT go as usual.

· Consider whether alternative carriers may be a better option. You may have better rates from the incumbent carrier, but when including a value-added service, the total cost may increase. An alternate carrier may have a better solution in terms of cost and service. It may be the case that your current carrier and a 3PL provides for the best solution. Be honest with your carrier since you are building a more collaborative relationship.

· Start with a pilot implementation. Logistics processes entail a lot of detail. Make sure to get these details understood and handled properly before making a major shift in your processes.

· Realize you are entrusting them with mission-critical processes, so the cost and impact of switching to an alternative later may be much greater. Make sure you receive service and pricing assurances from your carrier that are commensurate with your commitment.

While your carrier may not have the right solution for providing an expanded level of service for your fulfillment value chain, working with a collaborative approach will improve the working relationship. The logistics industry is in transformation, and the traditional carriers will continue to be challenged. So, whether you carrier innovates to offer new services or acquires or allies with another company who is an innovator, having collaborative relationship can only help.

Mike Comstock is Senior Advisor at Grand Canal Solutions and the co-founder of Ursa Major Associates, LLC. He can be contacted at mike@grandcanals.com.