With each year’s General Rate Increase announcement, shippers inevitably ask, “How much is this really going to cost me?” This year, it got quite a bit harder to answer that question for FedEx shippers.

On September 19, the Memphis-based transportation firm announced a GRI of 3.9% for Express and International, and 4.9% for Ground, Home Delivery, and Freight services. FedEx SmartPost rates will also change, but rates are not yet available for preview. While the latest announcement is more modest than in previous years, the true impact may be costlier for many customers due to service guide changes such as the reduction in dimensional weight factor from 166 to 139.

FedEx has indicated that the change simplifies calculation of dimensional weight by standardizing the dimensional weight factor to 139 for all domestic and international Express and Ground packages; this change will also increase costs for some shipments by over 20%.

To help shippers understand the impact of the 2017 GRI, we will explore the impact of the dimensional weight change in some detail, and then review overall price increases, selected changes in surcharges, and compare the FedEx announcement to UPS planned increases in 2017.

Fig 1. Top 25 Box Sizes and minimum billable weight by dim factor.

| L | W | H | Cubic Inches | Bill Weight 194 | Bill Weight 166 | Bill Weight 139 |

| 4 | 4 | 4 | 64 | 1 | 1 | 1 |

| 5 | 5 | 5 | 125 | 1 | 1 | 1 |

| 6 | 6 | 4 | 144 | 1 | 1 | 2 |

| 8 | 6 | 4 | 192 | 1 | 2 | 2 |

| 6 | 6 | 6 | 216 | 2 | 2 | 2 |

| 12 | 6 | 6 | 432 | 3 | 3 | 4 |

| 10 | 8 | 6 | 480 | 3 | 3 | 4 |

| 8 | 8 | 8 | 512 | 3 | 4 | 4 |

| 12 | 12 | 4 | 576 | 3 | 4 | 5 |

| 12 | 12 | 6 | 864 | 5 | 6 | 7 |

| 10 | 10 | 10 | 1000 | 6 | 7 | 8 |

| 12 | 12 | 8 | 1152 | 6 | 7 | 9 |

| 12 | 12 | 12 | 1728 | 9 | 11 | 13 |

| 16 | 12 | 12 | 2304 | 12 | 14 | 17 |

| 18 | 12 | 12 | 2592 | 14 | 16 | 19 |

| 14 | 14 | 14 | 2744 | 15 | 17 | 20 |

| 24 | 12 | 12 | 3456 | 18 | 21 | 25 |

| 16 | 16 | 16 | 4096 | 22 | 25 | 30 |

| 18 | 18 | 16 | 5184 | 27 | 32 | 38 |

| 18 | 18 | 18 | 5832 | 31 | 36 | 42 |

| 18 | 18 | 24 | 7776 | 41 | 47 | 56 |

| 24 | 18 | 18 | 7776 | 41 | 47 | 56 |

| 20 | 20 | 20 | 8000 | 42 | 49 | 58 |

| 22 | 22 | 22 | 10648 | 55 | 65 | 77 |

| 24 | 24 | 24 | 13824 | 72 | 84 | 100 |

We’ll now consider a few examples.

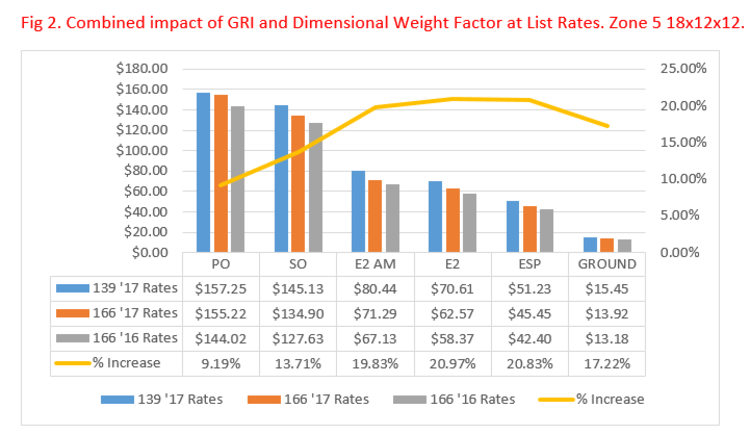

Consider a Zone 5 shipment that weighs 15lb and measures 18x12x12, or 2592 cubic inches. Beginning January 2nd, this box will be billed at 19lb, an increase of 3lb over the 16lb bill weight based on 2016 rules. At list prices, the net increase on this package ranges from 9.19% to 20.97%, much higher than announced increases.

Fig 2. Combined impact of GRI and Dimensional Weight Factor at List Rates. Zone 5 18x12x12.

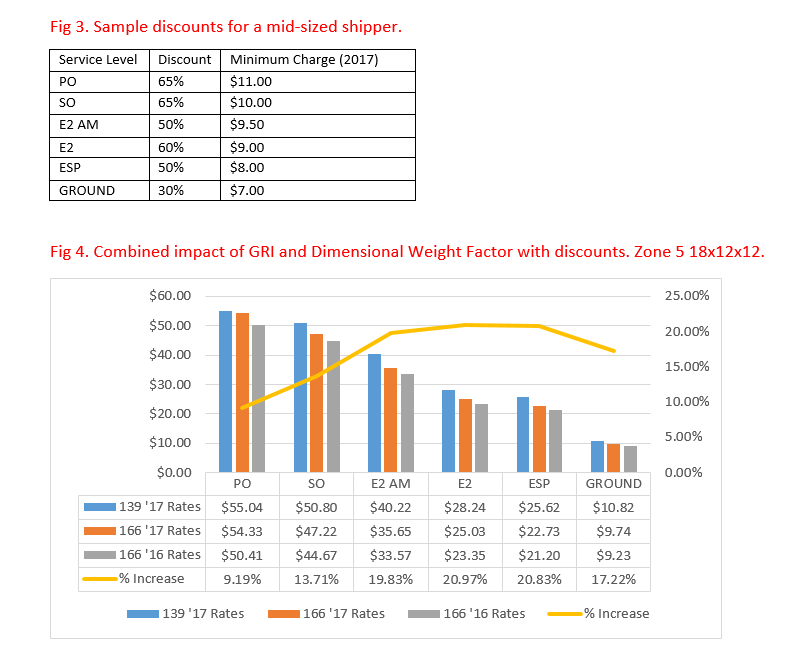

Let’s consider the same package, with hypothetical discounts for a mid-sized shipper.

Applying discounts has reduced the dollar amount, while the percentage price increase remains the same.

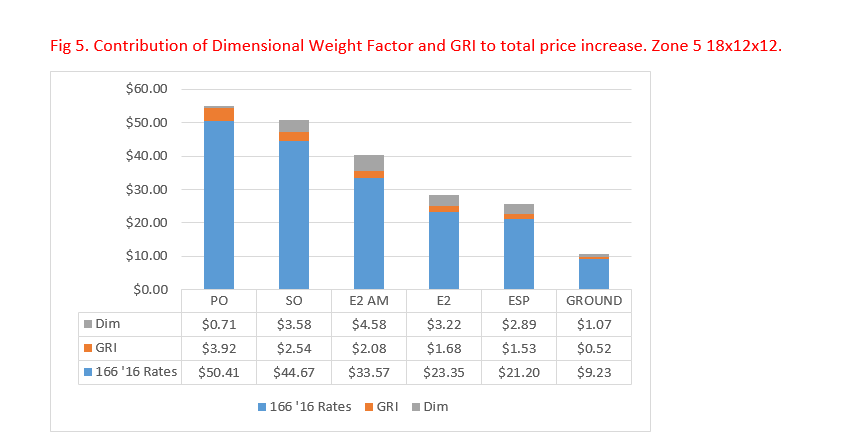

The chart below illustrates how prices change for this shipment beginning with the 2016 rate with a 166 dim factor, adding the GRI – the 2017 rate for same weight, and then adding the cost of the Dim weight – or the difference between 19 and 16lb for 2017.

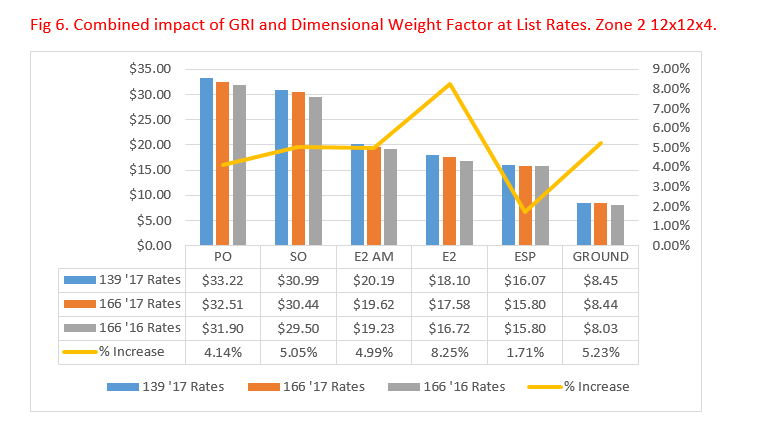

Now let’s consider a 3lb, Zone 2 shipment in a box that measures 12x12x4, or 576 cubic inches. Beginning January 2nd, this box will be billed at 5lb, an increase of 1lb over the 5lb billed weight based on 2016 rules.

The impacts here are more subdued as FedEx raised rates less aggressively in zones 2-3 than in longer zones.

This same package with discounts applied costs the same for 2 day service and deferred products.

Fig 7. Combined impact of GRI and Dimensional Weight Factor with Discounts. Zone 2 12x12x4.

The general pattern is that longer zone, larger size, premium express shipments will be more impacted by this change than shorter zone, smaller size, deferred deliveries. A thorough, custom analysis would be required to clearly understand how these changes will impact a specific shipping profile.

Breaking down the GRI

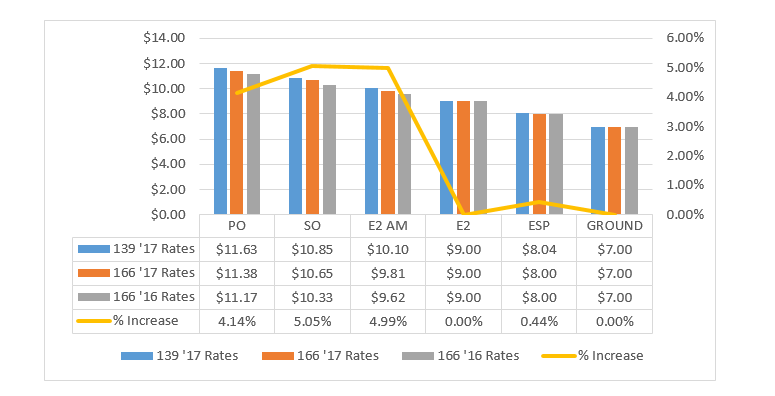

As with previous years, FedEx did not increase prices consistently across services, zones, and weight breaks.

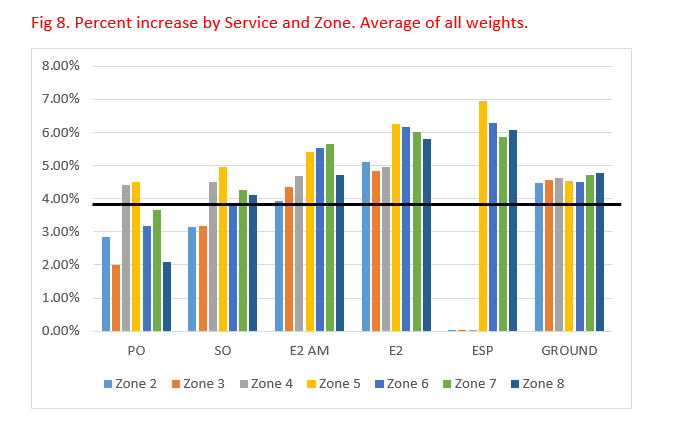

In the Express segment, also in line with prior year patterns, FedEx has unevenly applied price increases, averaging 3.24% for Priority Overnight, and 5.6% for 2 Day. Interestingly, Express Saver rates do not increase for Zones 2-4, but Zones 5-8 prices have risen by an average 6.3%.

The line at 3.9% guides us to some interesting insights. Almost every service + zone combination below the line occurs in Zones 2-4, with Priority Overnight being the exception. We can also observe overall increases being higher for deferred services than premium, high speed products.

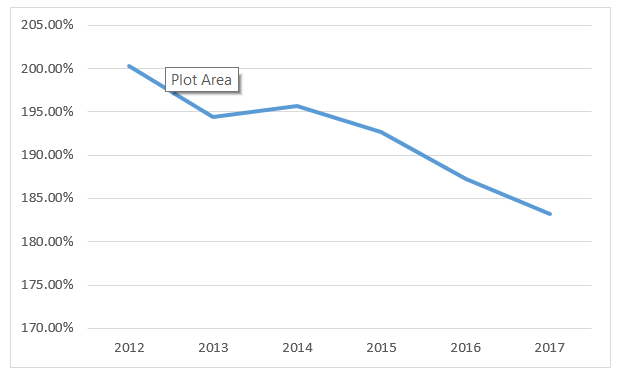

This has been a pattern for at least 5 years now, with FedEx continuing to reduce what I call the “speed premium,” or the relative price increase a shipper must pay to get a faster delivery.

Fig 9. Speed Premium. Relative cost of Priority Overnight vs. 2 Day at List Rates.

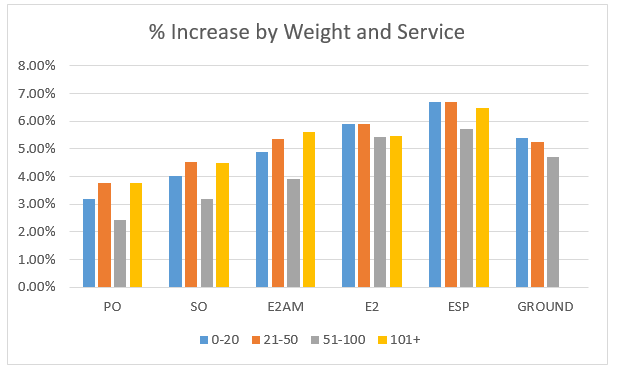

Shippers with significant volumes in the 51-100lb range are in luck, as prices in this weight break were raised less than others across the board. Premium Services (PO, SO, E2AM) show a pattern of raising prices more at higher weights, excluding 51-100lb. This is a departure from 2016 where we observed higher price increases at lower weights. On average, the spread for deferred services (E2, ESP, GROUND) is tighter than with premium, at .99% compared to 1.46% for premium.

Fig 10. Percent Increase by Weight and Service. Note ESP includes Zones 5-8 only.

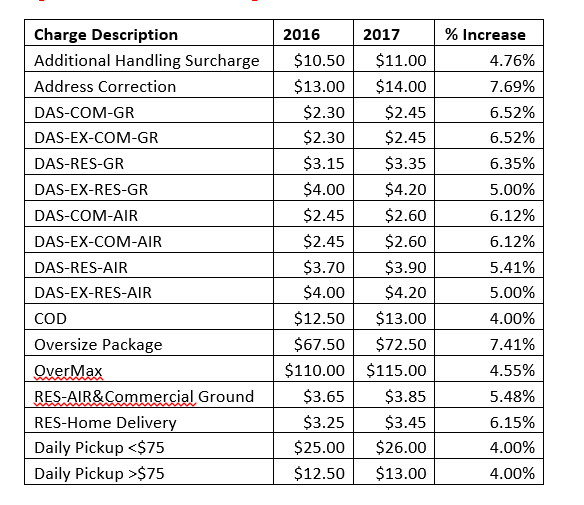

Modest Surcharge Increases for 2017

Surcharges can add significant costs to the price of a shipment, and 2016 saw some of the largest surcharge increases in recent memory. From 2015 to 2016, the list rate for Additional Handling and Oversize rose from $9 to $10.50 and $57.50 to $67.50, representing increases of 16.7% and 17.4% respectively.

In 2017, FedEx has taken more moderate increases in surcharges, with AHS and Oversize increasing from $10.50 to $11 and $67.50 to $72.50 or 4.76% and 7.41% respectively. Other common surcharges have risen by approximately 5.5% on average.

Fig 11. Selected FedEx Surcharge Increases

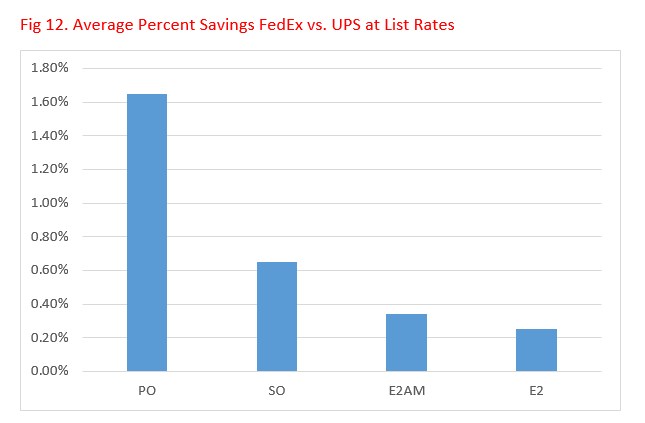

Comparison to UPS

In 2016, most FedEx domestic rates matched UPS to the penny, with ESP being the most notable exception. 2017 is a very different scenario. With no alignment in list rates, customers can no longer simply compare discounts and minimums to get a quick calculation of who offers the better deal.

FedEx list rates are now cheaper on average than UPS for Next Day and 2nd Day services when comparing same weight and zone. That said, FedEx will apply dimensional pricing at 139 vs. UPS at 166 which will eliminate list price savings in many cases due to higher billable weights. Also the relative price varies across carriers by weight and zone, so detailed analysis would be required to understand the potential value of switching to a particular customer.

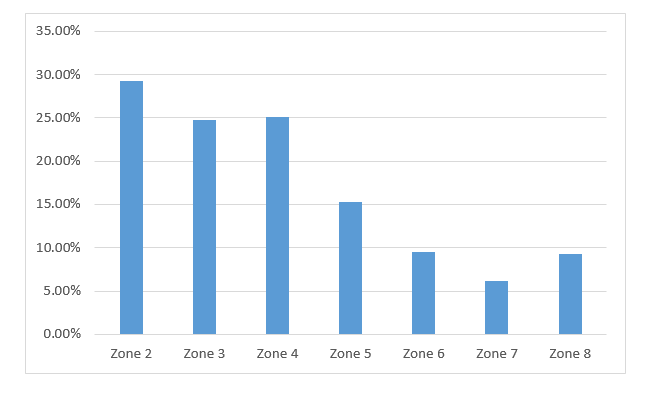

FedEx still prices Express Saver significantly higher than UPS 3 day at list rates, and much more so in the shorter zones. Zones 2-4 average 26.4% more than UPS, which is especially notable since FedEx took no price increase in these zones for ESP.

Fig 13. Average premium for FedEx Express Saver vs. UPS 3 Day Air by Zone. List Rates.

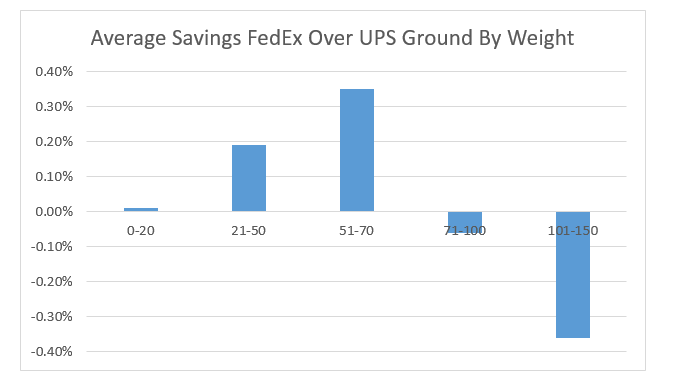

On average, FedEx Ground list rates are .05% higher than UPS for 2017. Weight break analysis tells a different story, with FedEx being cheaper on average below 70lb, and only becoming more expensive at the higher weights. Again, the Dim factor must be considered to understand the true difference in costs.

Closing Thoughts

Going into 2017, managing transportation spend is becoming even more complicated. Here are just a few of the changes:

- · 2017 List Rates Announced (Both Carriers)

- · Dimensional Weight Factor Reduced from 166 to 139 (January 2017, FedEx Only)

- · Weekly Fuel Surcharge Adjustment (February 2017, FedEx Only)

- · AHS Size limit reduced from 60” to 48” (Both Carriers)

- · Surcharge Price Increases: AHS, Address Correction, Dangerous Goods, Delivery Area Surcharges, COD, Signature Options, Oversize Package, Residential Delivery

- · UPS 3rd Party Billing Fee

As all shipments will not be impacted in the same way, it’s important for shippers to understand their package characteristics and have access to analytical tools to thoroughly model the impact of all carrier pricing changes.

Download the PDF for an easily printable version of this analysis!

David Faour currently serves as Shipware’s Sr. Director of Strategy & Analytics, following over a decade in Sales, Marketing, and Pricing related roles at FedEx. In addition to being a thought leader in the transportation space, David also has deep expertise in technology with a focus on data science and software engineering, having previously held technology leadership roles at General Electric and at a startup subsequently acquired by Oracle. Mr. Faour has earned an MS in Computer Science from the Georgia Institute of Technology, an MBA from the University of Florida, and a BS from the University of Central Florida. David welcomes questions and comments, and can be reached at 858.724.0456 or david@shipware.com.

View 2017 GRI Dim Article.pdf